Save your crypto, borrow USDT against it

Join 35,000 people who have borrowed over $670M with us!

Flexible loan

Borrow and repay anytime. Perfect for a volatile market.

Fixed loan

For long-term crypto plans – invest without overpaying.

Stable loan

Keep savings in USDC, DAI, or USD1 but need USDT? This option is for you.

Borrow and repay anytime. Perfect for a volatile market.

For long-term crypto plans – invest without overpaying.

Keep savings in USDC, DAI, or USD1 but need USDT? This option is for you.

USDT

3 months

3M

6 months

6M

12 months

12M

Total repayment

-

Issuing fee

-

Maturity date

-

APR

-

Issuing fee

No fee

Monthly Interest

-

Bitcoin-backed loans you can trust!

Cropty makes it easy and safe to tap into liquidity without having to sell your bitcoin. Here’s why bitcoin holders everywhere are fans of Cropty:

Global Access

Available in 100+ countries worldwide

Secure Custody

Your assets and collateral are protected with top-level security

120,000+ Loans

Already issued to over 35,000 users

$670M+ Borrowed

Total volume borrowed through Cropty Wallet

Your Gateway to Smarter Crypto Borrowing

Choose your loan

Stable

Borrow using stablecoins, up to 75% LTV

3 months

0% interest, repay in 3 months

6 months

0% interest, repay in 6 months

12 months

0% interest, repay in 12 months

Flexible

Instant USDT, no long-term commitment.

Loan currency

Tether USD

Maximum loan amount

$10,000 per loan & unlimited for each user!

Collateral

+50 tokens

Loan-to-value (LTV)

Up to 75%

APR

18%

Without interest

18%

Issuing fee

Free

4%

6%

10%

Free

Loan Term

∞

3 months *

6 months *

12 months *

∞

Recurring payments

No

Early Repayment

Yes

Yes, but the issuing fee is non-refundable.

Yes

Margin call LTV

90%

Liquidation LTV

97%

* After the loan term ends, if no repayment occurs, Fixed loan will be converted to Flexible.

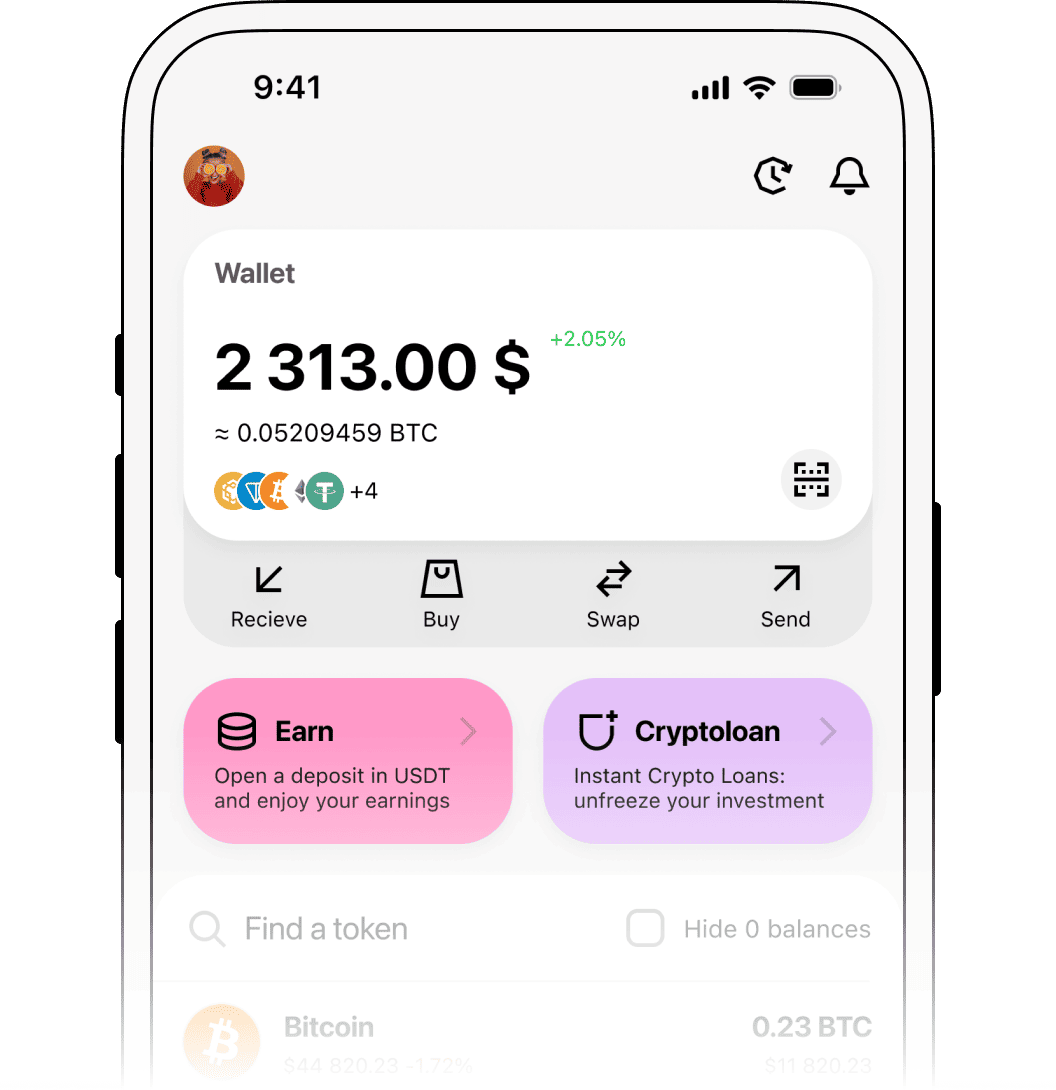

How to Borrow Cryptocurrency

Getting a crypto loan is easy — just follow these simple steps.

1

Deposit Crypto Collateral

Add the cryptocurrency you want to use as collateral into your wallet. This is what secures your loan.

2

Create Your Loan

Go to the "Cryptoloan" tab, pick your collateral, and choose the amount you want to borrow.

3

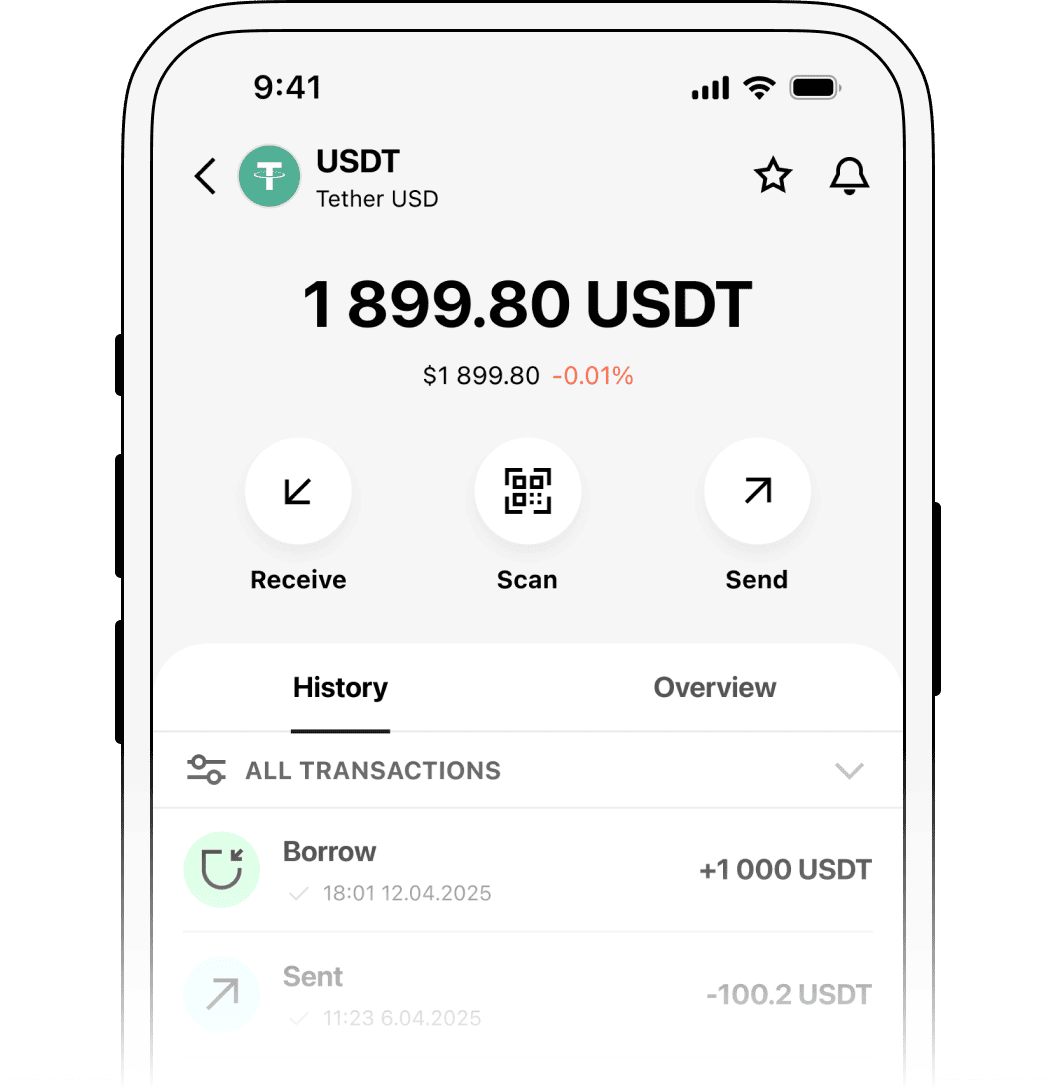

Receive funds instantly

Once your loan is approved, the funds appear in your wallet right away. You can use them however you want.

How to Borrow Cryptocurrency

Getting a crypto loan is easy — just follow these simple steps.

Crypto Loans Explained

How do Crypto Loans work?

Fixed

Flexible

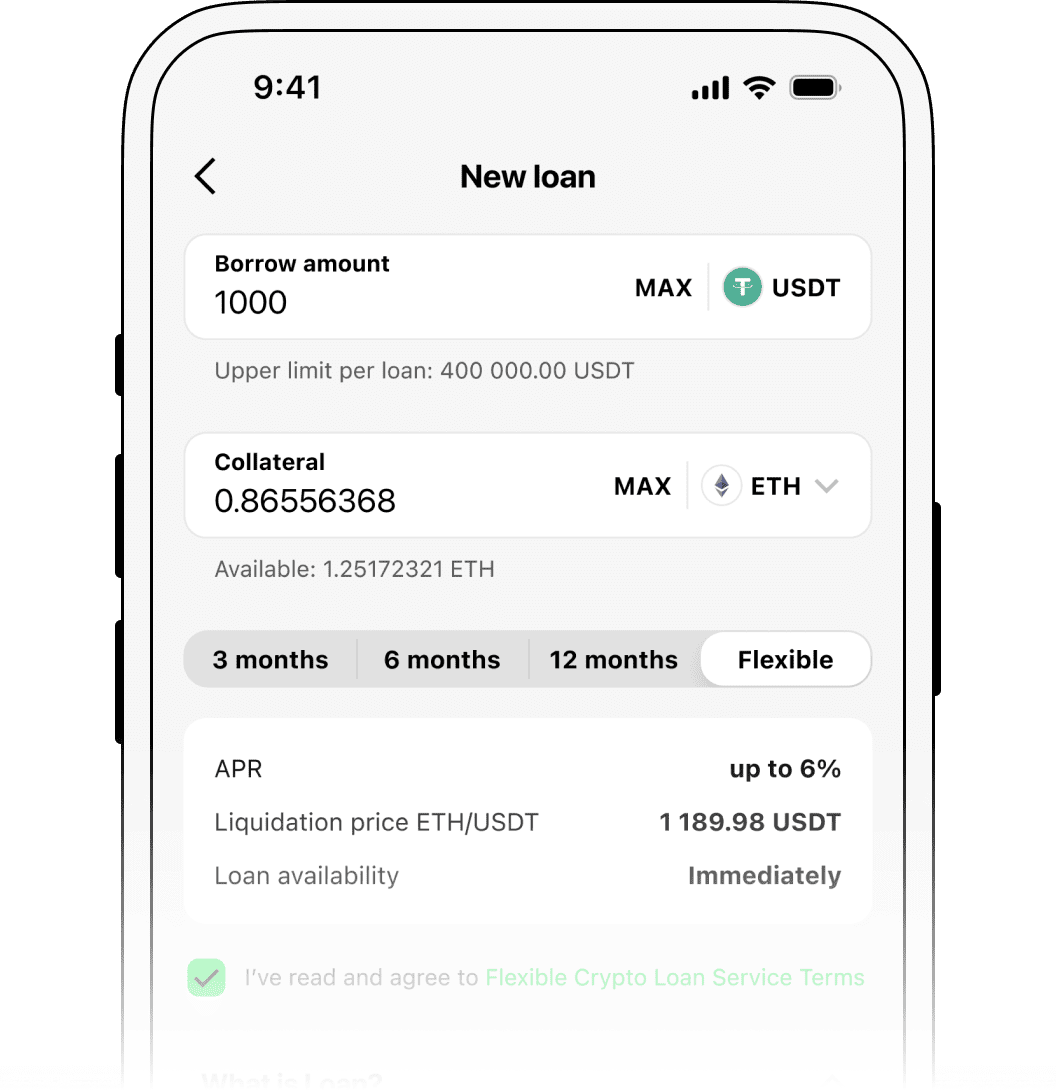

Submit Application

Choose your loan amount in USDT and select a term (3 / 6 / 12 months). Check the applicable fee (4% / 6% / 10%).

Choose Collateral

Select a cryptocurrency as collateral (TRX, BTC, ETH, etc.). Make sure the initial LTV is within the allowed limit.

Confirm Terms

Review all loan details: amount, term, fee, LTV, and liquidation price. Confirm to lock your collateral and pay the fee.

Receive Funds

Funds are credited instantly. Monitor your LTV—add more collateral if it rises to avoid liquidation.

Repay Loan

Repay your loan by the due date. Once repaid, your collateral is released. If not repaid, collateral may be sold at the liquidation price.

1

Submit Application

Choose your loan amount in USDT. The system calculates the maximum based on your collateral. APR 18%, no fees, liquidation price applies.

2

Choose Collateral

Select a cryptocurrency as collateral (TRX, BTC, ETH, etc.). Make sure the initial LTV is within the allowed limit.

3

Confirm Terms

Review all loan details: amount, term, fee, LTV, and liquidation price. Confirm to lock your collateral.

4

Receive Funds

Funds are credited instantly. Monitor your LTV — add more collateral if it rises to avoid liquidation.

5

Repay Loan

Repay anytime — no fixed date. Collateral is unlocked after repayment. If value drops to the liquidation level, it may be sold partly or fully.

Collateral Freedom

Choose from Bitcoin to altcoins — our wide selection lets you pick the perfect collateral for your loan.

Bitcoin

Get $66932 for 1 BTC

Ethereum

Get $2256 for 1 ETH

BNB

Get $680 for 1 BNB

Ripple

Get $145 for 100 XRP

Solana

Get $954 for 10 SOL

USD Coin

Get $750 for 1000 USDC

Tron

Get $219 for 1000 TRX

Dogecoin

Get $951 for 10000 DOGE

Cardano

Get $271 for 1000 ADA

Bitcoin Cash

Get $446 for 1 BCH

ChainLink

Get $896 for 100 LINK

Zcash

Get $295 for 1 ZEC

Dai Stablecoin

Get $750 for 1000 DAI

Litecoin

Get $523 for 10 LTC

Avalanche

Get $910 for 100 AVAX

World Liberty Financial USD

Get $750 for 1000 USD1

SHIBA INU

Get $586 for 100000000 SHIB

World Liberty Financial

Get $124 for 1000 WLFI

TON Coin

Get $115 for 100 TON

Cronos

Get $684 for 10000 CRO

Polkadot

Get $141 for 100 DOT

Uniswap

Get $363 for 100 UNI

Aave

Get $120 for 1 AAVE

Tether Gold

Get $3955 for 1 XAUT

OKB

Get $804 for 10 OKB

NEAR Protocol

Get $111 for 100 NEAR

Ethereum Classic

Get $868 for 100 ETC

Polygon

Get $898 for 10000 POL

Decentralized USD

Get $750 for 1000 USDD

Cosmos

Get $170 for 100 ATOM

Quant

Get $602 for 10 QNT

Filecoin

Get $958 for 1000 FIL

VeChain

Get $765 for 100000 VET

Tezos

Get $420 for 1000 XTZ

Chiliz

Get $427 for 10000 CHZ

TrueUSD

Get $750 for 1000 TUSD

First Digital USD

Get $751 for 1000 FDUSD

Immutable X

Get $178 for 1000 IMX

The Sandbox

Get $943 for 10000 SAND

Decentraland

Get $104 for 1000 MANA

Flow

Get $548 for 10000 FLOW

Binance USD

Get $751 for 1000 BUSD

Notcoin

Get $409 for 1000000 NOT

Catizen

Get $430 for 10000 CATI

DOGS

Get $291 for 10000000 DOGS

Hamster Kombat

Get $168 for 1000000 HMSTR

Major

Get $707 for 10000 MAJOR

EOS

Get $141 for 1000 EOS

Huobi Token

Get $683 for 1000 HT

Maker

Get $1063 for 1 MKR

Unlock Endless Possibilities

With Cropty's Crypto-Backed Loans

FROM $1 TO $1M

Available for borrowing

Instant Approval

No Credit Checks

75% LTV

High Loan-to-Value Ratios

Big Buys Made Easy

Use your loan to renovate, get a new ride, fund your education, or take the vacation of your dreams.

Tax-Smart Moves

Access funds without selling your crypto and avoid potential taxable events. Smart, right?

More Crypto, More Fun

Collateralize your crypto and invest in other digital assets, stocks, gold, or even real estate.

Boost Your Biz

Grow your business without selling crypto—cover costs, pay employees, or seize opportunities.

Real Estate Ventures

Invest in property, buy your dream home, or fund renovations faster than with traditional loans.

Debt-Busting

Pay off high-interest debt with one simple loan—no credit checks needed!

Crypto Loan Calculator

Crunch the Numbers and Discover Your Loan Potential

USDT

3 months

3M

6 months

6M

12 months

12M

Flexible

APR

-

Issuing fee

-

Maturity date

-

Monthly Interest

-

Quarterly Interest

-

Yearly Interest

-

What is Cropty Crypto Loan?

Crypto Loans at Cropty, or loans backed by cryptocurrency, are a type of financial service that allows borrowers to obtain funds instantly by using their digital assets as collateral. Cropty's unique approach enables individuals to access liquidity without having to sell their cryptocurrencies, thus avoiding potential tax implications or loss of future appreciation.

Here's a step-by-step breakdown of how Crypto Loans work at Cropty:

Register on Cropty

First, you need to create an account on the trusted and reputable Cropty platform, which offers instant Crypto Loan services.

Deposit collateral

To obtain a Crypto Loan, you must deposit an amount of cryptocurrency as collateral. Cropty will securely store your digital assets for the duration of the loan. The amount of collateral required will depend on the Loan-to-Value (LTV) ratio, which is the proportion of the loan amount relative to the value of the collateral.

Loan approval

Once your collateral has been deposited, Cropty will assess the LTV ratio and instantly approve the loan without any credit checks, making it accessible for a wide range of borrowers.

Receive funds

After loan approval, you'll receive the funds in your designated account. Cropty only provides loans in the form of USDT (Tether), a stablecoin pegged to the US Dollar.

Flexible interest payments

During the loan term, you're not required to make regular interest payments. Instead, interest accrues over the loan duration, providing you with flexibility in managing your financial obligations.

Loan repayment

You can repay your loan at any time without incurring penalties. Once you've returned the borrowed USDT amount plus any outstanding interest, your collateral will be released back to you.

Defaulting and liquidation

If the value of your collateral falls below a specified threshold, Cropty may issue a margin call, requesting that you deposit additional collateral to maintain the LTV ratio. If you're unable to meet the margin call, Cropty may liquidate a portion or all of your collateral to recover the loan amount and any outstanding interest.

Crypto Loans at Cropty provide a flexible and instant financing solution for individuals looking to leverage their digital assets without having to sell them. As more people recognize the potential of cryptocurrencies and their role in the global financial ecosystem, Cropty's innovative financial product continues to gain popularity.

Crypto Loans vs Conventional Loans

Instant Crypto Loans

Conventional Loans

Boost Your Crypto Game

Grow your crypto portfolio without selling your assets, giving you more flexibility and potential.

Instant Crypto Loans

Conventional Loans

YES

NO

Lower Rates, More Savings

Enjoy competitive interest rates and save compared to conventional loans.

Instant Crypto Loans

Conventional Loans

YES

NO

Skip the Origination Fees

No origination fees, so you can focus on what really matters.

Instant Crypto Loans

Conventional Loans

YES

NO

Tax-Friendly

Avoid potential tax issues from selling crypto and benefit from tax-efficient solutions.

Instant Crypto Loans

Conventional Loans

YES

NO

Instant Approval

Get approved immediately, skipping the long waits of traditional loans.

Instant Crypto Loans

Conventional Loans

YES

NO

Paperless Process

Apply easily with our hassle-free, fully digital process.

Instant Crypto Loans

Conventional Loans

YES

NO

Flexible Repayments

Repay on your schedule, no mandatory monthly payments.

Instant Crypto Loans

Conventional Loans

YES

NO

Keep Your Credit Score Safe

Our loans don’t affect your credit score, keeping your financial reputation intact.

Instant Crypto Loans

Conventional Loans

YES

NO

Easily Track Your Loan in a Volatile Crypto World

Cropty helps you stay in control of your loan with smart features that make tracking simple and stress-free:

Margin Call Alerts

We send timely alerts when your collateral needs topping up or partial repayment to keep your loan safe.

Visual indicators let you quickly see your Loan-to-Value ratio, so you can make smart decisions on the fly.

Top Up Anytime

Add collateral or make extra payments anytime to avoid liquidation and keep your loan secure.

Collateral secures both you and the platform, giving instant access to USDT, eliminating default risk, and ensuring transparency.

Yes! Cropty Crypto Loans are fully secured by your collateral. Your assets stay locked while you get instant USDT liquidity, clear LTV monitoring, automatic protection, and no hidden fees.

Why Cropty

Trusted platform

Cropty has been operating since 2019, providing secure crypto services worldwide. Thousands of users rely on Cropty for safe storage, instant transactions, and reliable loans.

No credit check required

Your eligibility is based solely on your crypto collateral. Cropty never requires a credit score — get instant access to liquidity with no paperwork or delays.

Transparent rates and flexible options

Choose between fixed-term loans with a one-time origination fee (3, 6, or 12 months) or flexible loans with daily interest at 18% APR. No hidden costs, no monthly payment stress.

Secure collateral management

Your collateral is safely locked in your Cropty wallet. With real-time LTV monitoring, automatic liquidation protection, and immediate access to borrowed funds, your assets are always under control.

Backed by best

FAQ

What is Cropty Crypto Loan?

Cropty Crypto Loan is a secure, overcollateralized, and flexible loan product. Users can take loans by pledging their crypto assets as collateral. With Cropty, you don't have to worry about rehypothecation since we don't lend out your collateralized crypto to others.

How do I pledge my assets and start borrowing with Cropty Crypto Loan?

To start, choose the crypto you'd like to pledge as collateral and the amount you'd like to borrow. Ensure you have sufficient crypto assets in your account to cover the required collateral. Once the process is complete, your collateral will be locked, and the loan will be transferred to your account.

What is LTV, and how much can I borrow from Cropty Crypto Loan?

LTV (Loan-to-Value) represents the ratio between the value of the loan plus accrued interest and the value of your collateral. The LTV percentage determines how much you can borrow based on the collateral you pledge. For example, with a 50% LTV, if you pledge 1,000 USDT, you may borrow up to 500 USDT worth of assets.

Are there limits to how much I can pledge and borrow?

Yes, there are limits for each cryptocurrency. The maximum amount you can pledge or borrow depends on the specific crypto and may change periodically.

What is loan liquidation, and what is the liquidation LTV?

Loan liquidation occurs when the current LTV exceeds the liquidation LTV, which may happen if the collateral's value decreases or the loan's value increases. If liquidation occurs, you may lose some or all of your collateral.

What happens when a loan is liquidated?

When liquidation occurs, the outstanding loan amount will be repaid using the equivalent value of collateral. A partial liquidation happens when the liquidation doesn't fully cover the outstanding loan, and a full liquidation occurs when the entire loan is repaid using the collateral.

What is a margin call?

A margin call is a warning issued when your collateral-loan pair position reaches its margin call LTV. You can take action by adding more collateral or reducing the outstanding loan to lower the LTV.

Will I be notified in the event of margin calls or liquidations?

Yes, Cropty will send notifications via email and SMS in case of margin calls or liquidations. However, timely delivery of these notifications cannot be guaranteed.

What interest rate applies to my loan?

Cropty provides transparent interest rates for each cryptocurrency. Please refer to the platform for up-to-date interest rates.

How is interest accrued for my loan positions?

Interest accrues based on the total outstanding loan amount and the prevailing APR. The interest accrued is added to the total outstanding loan.

How do I repay my loan or adjust my LTV?

Use the 'Repay' or 'Adjust LTV' options in your account to repay loans or adjust collateral, respectively. You can only repay your loan using the same cryptocurrency you borrowed.

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

Cropty Crypto Loan accepts a variety of cryptocurrencies as loanable and collateral assets. The list of available cryptocurrencies is updated periodically, so please refer to the platform for more information.

What can I do with the cryptocurrencies borrowed from Cropty Crypto Loan?

You can use the borrowed cryptocurrencies for various purposes, including trading, investing, or withdrawing from the platform. The collateral you pledge remains with Cropty as security for the repayment of your loan.

Can't find the answer to your question? Visit our support center